Contextual Inquiry and Task Analysis-Group:!Xobile

From CS 160 Fall 2008

Team

- Mu-Qing Jing - Interviewed subject #4, wrote the Task Analysis Questions section, and wrote the Analysis of Approach section.

- Geoffrey Lee - Helped write-up contextual inquiry script, interviewed subject #1 with Ben, created interface graphics, and wrote interface design section.

- Perry Lee - Interviewed subject #2, and wrote the Analysis of Tasks section.

- Shaharyar Muzaffar - Interviewed subject #3, wrote Problem and Solution Overview, and wrote Part of Target Users

- Bing Wang - Helped come up with a script for the interview, interviewed subject #1 with Geoffrey, and wrote the contextual analysis and interview section

Target Users (4 pts)

Click here to see the detailed notes from the interview

Subject One

Subject One is a senior MEB major at UC Berkeley who is preparing for optometry school. He is very comfortable with computer games and online Flash games, and has a good understanding of typical computer interfaces. Video games are actually one of his favorite ways of taking a break from studying. He does not currently view retirement planning as a high priority for another 10 years. His current knowledge of investment options is limited to what his father taught him about the checking, savings, and mutual fund accounts that he owns.

Subject Two

Subject Two is a 22 year old student attending UC Berkeley. He is currently majoring in EECS and Materials Science, and works in an IT environment, specifically as a system administrator. He can be said to represent the typical engineer. In terms of priorities (as related to our project), planning for his retirement is not a very high one -- although it appears he has looked into his retirement options *very* briefly. His highest priority is most likely to graduate, followed by finding a job.

Subject Three

Subject Three is a 21 year old Psychology major at UC Davis who plans on going to graduate school once she graduates. Her financial knowledge was gained from her parents, her sister whom works at a bank, and owning a checking and savings account. She does eventually want to plan for retirement, but currently does not feel the need to look into it. She using a computer daily, but her gaming is limited to occasional sessions of Rock Band.

Subject Four

Subject Four is a 22 year old intern at a law firm that graduated from UC Berkeley recently. He majored in Environmental Economics and Policy, and used to work in an IT environment, specifically as a Residential Computing Consultant. He is from Kansas, and holds many of the conservative tendencies that the region is most known for. In his spare time, he plays a lot of computer and video games. For him, planning for retirement is not a very high concern; bigger concerns are getting into law school and/or finding a paid job.

Rationale For Selecting Users

Our main goals for the types of subjects we chose to interview was to ensure all subjects fit within our target age range, had a different field of study, and had different levels of experience with video games. Our target age range was 18 to 24, because at this age, most people are students in college or working at their first career job. We thought people in this age range would benefit most from our game, and also, most would already be familiar with flash games. We felt that the subject's specialization should be different, because people from different fields could interpret visual imagines differently. Also, their knowledge about financial investments would most likely be more different than those of the same field. We also wanted to include people who were experienced with games, because we wanted to ensure that we do not make the game or it's interface too simple and boring. However, we also included those with minimal game experience to ensure the game is easy enough to pick up.

Subject Comparison Table

| Test Subject | One | Two | Three | Four |

|---|---|---|---|---|

| Age | 21 | 22 | 21 | 22 |

| Field of Study | MEB at UC Berkeley; | EECS and Materials Science at UC Berkeley; | Psychology at UC Davis; | Environmental Economics and Policy at UC Berkeley; |

| Occupation | Student; System Administrator for IT Environment; | Student; | Student; Legal Assistant; | Student; |

| Extent of Financial Knowledge | Limited; | Intermediate; | Limited; | Intermediate; |

| Source of Financial Knowledge | Parents; Experience from using Checking Account and Mutual Funds; | Self-taught; Word of Mouth; News; | Parents; Experience from using Checking Account and Savings Account; | Self-taught; Online |

| Importance of Investment Planning | Low; | Low; | Low; | Low; |

| Game Usage | Frequently; | Frequently; | Rarely; | Frequently; |

| Rationale for Selecting | Frequent Gamer; | Intermediate knowledge of investments; | Limited knowledge of investments; Non-Gamer; | Intermediate knowledge of investments; Avid Gamer; |

Problem and Solution Overview (1 pt)

There is a significant problem in America where a large number of people do not prepare for retirement. Similarly, a significant number of Americans put the majority of their liquid assets in simple checkings or savings accounts. Not only do these funds generate very little in interest, but they might be outpaced by inflation. We believe that having a good sense of what each of these accounts provide is important for an individual to have a successful investment and retirement portfolios. Oftentimes, people just listen to their advisers but do not really understand the benefits of these accounts. Therefore, in order to raise awareness regarding the different alternative investment accounts that are available that are more appropriate for retirement purposes, our solution will challenge the user to manage their own accounts to earn the most money over time. By playing this game, the user will intuitively learn the different types accounts, their general trends, behaviors in terms of interest rates, volatility, and excitements as the money in each accounts go up and down.

Contextual Inquiry - Interview Descriptions and Results (15 pts)

Interview results

Click here to see the detailed notes from the interview

Methods

We conducted contextual inquiry on our customers in their home settings. With all of our customers being students, the home setting is the normal environment where they study or learn new things, decide upon which financial accounts they have, and play games.

Throughout our contextual inquiry process, we used the master-apprentice model that was covered in class and in the reading. We treated our customers as masters and attempted to learn from them. Our game focuses on teaching individuals knowledge regarding investment accounts. All of the individuals whom we interviewed had just checking and savings account which justifies that our game would be useful to teach many people something that they do not yet know. However, in terms of contextual inquiry, it would be difficult to assess them with regards to the investment accounts that they have. Instead we asked the user their financial backgrounds and their knowledge regarding some of the investment accounts; and we observed their behaviors with computer tasks that we assigned them so that we can come up with an interface that is natural to them.

We gave the users a series of tasks that would simulate some actions in our games to get an idea of what the user would do. First we observed the way that the user carried out those tasks. Then we followed up with questions to learn what went through their head when they carried out the required tasks. This way, we not only observed the “masters” while they were doing the required actions, we also interviewed them to make sure that we understood their actions.

Results

All of our users were college students, and most of them only have checking and savings accounts. When we asked them about terms such as 401k, Roth IRA and Money Market, only one person was able to come up with the definition which he picked up from reading tidbits of news. We also asked them which type of accounts they currently have, and only one individual had mutual fund account which was set up by his parents. Asked whether that they started to plan their retirements, all of them answered “no”. This study was done with three college students as participants, it is nowhere near comprehensive. However, we were able to show that this game is useful to college students to learn about different investment options.

As mentioned earlier, since most people did not have many investment accounts, it was hard to do a contextual inquiry on them. We focused the second part of the contextual inquiry on their learning process and how they incorporate games into their daily routines. We also observed their performing computer tasks that simulated similar motions and tasks that would be mimic some of the tasks in our game.

With regards to learning, we asked them how they gained their existing knowledge regarding investment options to better understand their learning process for our particular subject. None of them used game to learn about investment accounts which might prove that we are filling up a niche market. Another question that we asked was how often they played flash based games, only one person played regularly. We then asked our users to play a game of minesweepers so we can observe ways that they played games, and we can use the master-apprentice to learn what they do and not do. Since minesweeper involved many mouse clicks, we asked them whether they liked the mouse click interaction. We got positive feedbacks and would like to implement more mouse-click interactions. Lastly, we asked them to restart mine sweepers after a loss, 3/4 of them knew the F2 shortcut which shows that they do indeed use game as a way to relax. Furthermore, it showed that some individuals might like the keyboard shortcuts if they are seasoned game players.

One of the other task that we have is to transfer money between accounts. Since the process of transferring money in real life would be very different than the game, we instead ask the user to transfer files between two open directories on a computer. All the users showed drag and drop as one of the options, and one of the user noted that “it’s the first thing that came to my mind”. With this task mimicking transferring money in our game design, we will most likely use drag and drop as the interface.

Another task that we asked the users to perform was to find out how to add favorite in Internet Explorer 7. The users located the help menu from the toolbar and typed in the keyword “favorite” in the search. It showed us that the users would look for help when they want detailed information, and usually they would look at the help menu in the toolbar for help. We hope to incorporate this function in our game.

The last task that we asked the users to perform was to find insert a chart into Microsoft Word. We thought this would emulate how we can have the users insert a new account whenever they would like to open a new account. We observed their actions, and all of them looked for the “insert” menu and selected chart to insert the chart. Since our game do not require that many options, simply showing the account might just suffice.

One of the ideas that we had to add some excitement to the game was speed and randomness. We wanted to let the users be able to move around their accounts in order to maximize efficiency in the event such as a stock market crash. We tried to ask the user to arrange 5 different windows to fit on the desktop. Most of them had to iteratively resize the window as the windows are allowed to overlap one another. One of the points that we get from this is possibly have non-overlapping windows to minimize user frustration.

At this stage of development, we have not yet decided on some of the graphics that we would use. We focused our third stage of contextual inquiry on asking the user regarding their past association with certain events. We asked them to associate a visual cue that caused them to exercise caution and safety. We got a wide array of answers such as a warning sign, flares, the color red etc. We can incorporate what we learned from the users the design the safer investment accounts with these images so they can learn by association. Another question that we asked was regarding growth rate, the answers we got were red and green, thumbs up and thumbs down, numbers. We hope to use these to show volatility and possibly tradeoffs between risk and rewards.

Task Analysis Questions (5 pts)

Who is going to use system?

The system is going to be used by people who have money (or will have money shortly) but do not know much about different types of retirement/investment accounts. The majority of these people would be college graduates who have not had much financial independence/decision-making in the past. They are fairly well educated, and enjoy learning implicitly through immersion or hands-on activities. Most have a good amount of experience playing flash games, and can quickly pick up online games, as they are part of the computer generation.

What tasks do they now perform?

Most of the subjects actively practice the task of managing their checkbook and maintaining their savings account. Some of them have mutual funds that they are aware of, and they talk with their peers in order to understand more about different financial accounts. In terms of games, online flash games are very popular with college students. They play those games very frequently.

What tasks are desired?

Tasks desired relate to the opportunity to learn more about investment accounts through a fun and effective medium, such as an education game. Most of the subjects stated that they enjoy learning through hands-on experience. Essentially, they would rather learn without actively trying to learn. In this regard, the tasks they would want to learn are:

- Choose a better investment account

- Learn about different types of retirement funds

- Set up a good base for future retirement

How are the tasks learned?

In general, most of our subjects learned about investment accounts by talking with their peers and family members. Some turned to the Internet to gain a broader understanding, and some talk with experts (such as bankers).

A more effective approach is to have them learn through a hands-on game experience. This allows them to learn without realizing it, which is usually more effective for typically boring subject matters.

Where are the tasks performed?

The tasks tend to be performed where the subject spends most of their time. More often than not, that ends up being their desk, where they have most of their resources located.

What’s the relationship between user & data?

Users are able to store their high scores online, and are able to view other player's scores. Their nickname is associated with the score, so from a privacy standpoint there is very little that is in a gray area. The rules of the game are common among all users; options, however, can be customized such that the situations depicted by the game are different.

What other tools does the user have?

The user tends to have office-based tools at their disposal. Books, computers, monitors, writing utensils, paper, and office supplies seem to be around all the test subjects.

How do users communicate with each other?

Users usually communicate online, if other means are not possible. In that regard, many users tend to like using chatrooms specific to a particular site (i.e. Facebook chat or Meebo chat embedded within a website).

How often are the tasks performed?

The tasks can be performed as often as the user wants; the games are short enough that many iterations can be played through. This differs sharply with the typical way these tasks are learned, as it is strongly dependent upon the person's motivation and patience.

What are the time constraints on the tasks?

In the context of the game, the time constraints for the tasks are very lax; you play for however long you want to, and you take away as much as you can from that. Through other means, though, the time constraints will typically be 30 minutes to an hour, as most users will become bored of learning about investment accounts. The greatest advantage of the game is that it is able to distance the user from being aware of learning, which is usually the limiting factor in how long someone can spend their time on one subject matter.

What happens when things go wrong?

When things go wrong, it seems like people are more likely to go onto the Internet to look for a solution rather than using the help documentation built-in. Specifically, they seem to tend to look for non-official instructions first (i.e. Yahoo answers, forums, how-to guides, etc.). For example, when searching for information regarding how to add a bookmark to IE7, subject #4 first went to Google to look for a some sort of forum post rather than using the built-in help documentation, or even Microsoft's own knowledge base.

Analysis of Tasks (10 pts)

Transfer money from one account to another [In-Game Task / Difficult task]

Users use a drag and drop operation to transfer money from one account (A) to another account (B).

- In order to transfer money from A to B, a user drags money (the numerical figure) from A to B.

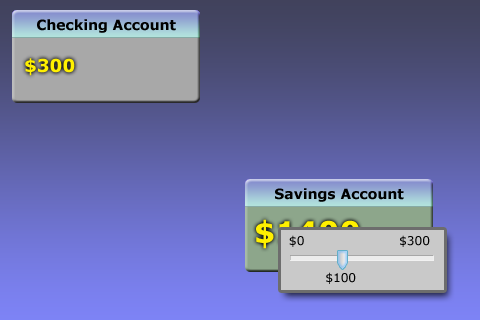

- Upon dropping the money on B, the mouse cursor becomes a slider, and the money in account A is frozen. Note that Account B is still active.

- From this point thereof, only movement along the x axis is tracked. The far left of the slider represents $0; and the far right of the slider represents all the money in account A.

- As a user moves the mouse, the amount of money that will be transferred is displayed as a numerical figure above the slider.

- When the user is satisfied with the amount of money to transfer, he/she left clicks once to confirm the transfer. At this point, A is unfrozen.

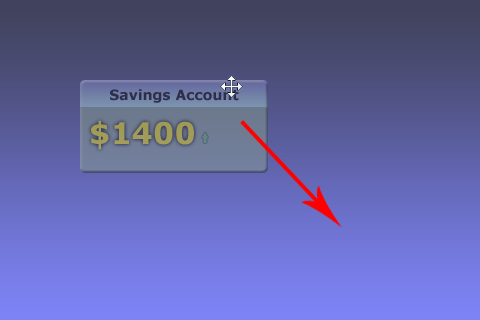

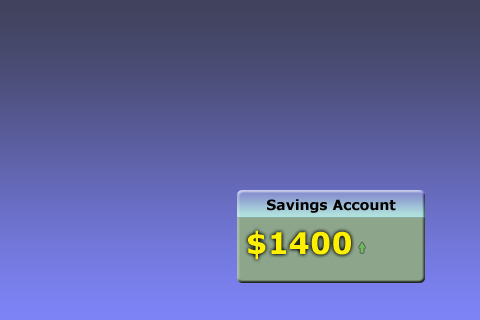

Rearrange the location of accounts [In-Game Task / Difficult task]

Users rearrange the location of accounts much like they'd expect in Windows or in Mac OS X. On the top of each account is a title that indicates the type of account (e.g., Stock Market Account). To move an account, users left click this title and drag and drop it to its new location.

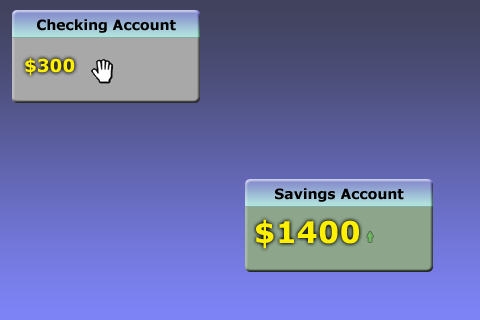

Identify how much money is an account [In-Game Task / Medium level task]

In the middle of each account, the amount of money stored is displayed as a numerical figure (e.g., $500). The size of the numerical figure reflects the amount of money in account (e.g., $300 would be displayed smaller than $900).

Identify volatility (gains/losses)

Gains are represented via two means:

- when the account is green / the arrow points upward

Losses are represented via two means:

- when the account is red / the arrow points downward

In both cases, the arrow is displayed to the right of the numerical figure (the amount of money in an account).

Adding (buying) a new account [In-Game Task / Medium level task]

Accounts that are available for purchase are displayed at the bottom of the game window. To purchase/add an account, users drag and drop the account they wish to buy from the bottom of the game window to a location of their choosing.

Start a new game / restart the game [Out-Of-Game Task / Easy task]

Users can start a new game via two means:

- Clicking the Start Game button / Pressing F2.

Users can restart the game via two means:

- Clicking the Menu button in the upper left corner of the game, and then clicking Restart / Pressing F2.

Getting help [Out-Of-Game Task / Easy task]

Users can get help via two means:

- Clicking the Help button in the upper left of the game window.

- Pressing F1.

Interface Design (20 pts)

Functionality summary (what you can do with it)

The goal of our game is to maximize the amount of money that the player earns for retirement through various investment accounts. To accomplish this, the player can purchase an investment account from a random market of investment options and transfer money across the different investment accounts.

Other out-game functions include accessing a high-score board and game tutorial.

User interface description and sketches (how you use it)

This is the main menu screen. The user interacts with this screen by using a mouse to click on the buttons. First time players will want to learn how to play the game by clicking tutorial, which will display a short animation of the various in-game functions. We also recognized that competitive players like having a high-score screen, so this is provided on the main menu as well. We chose not to provide a "quit" button because this will be an online Flash game, and users understand that they can leave the game anytime by navigating away or closing the browser.

When the user is currently in-game and opens the main menu, the "start game" button is replaced by 2 buttons for "restart game" and "back".

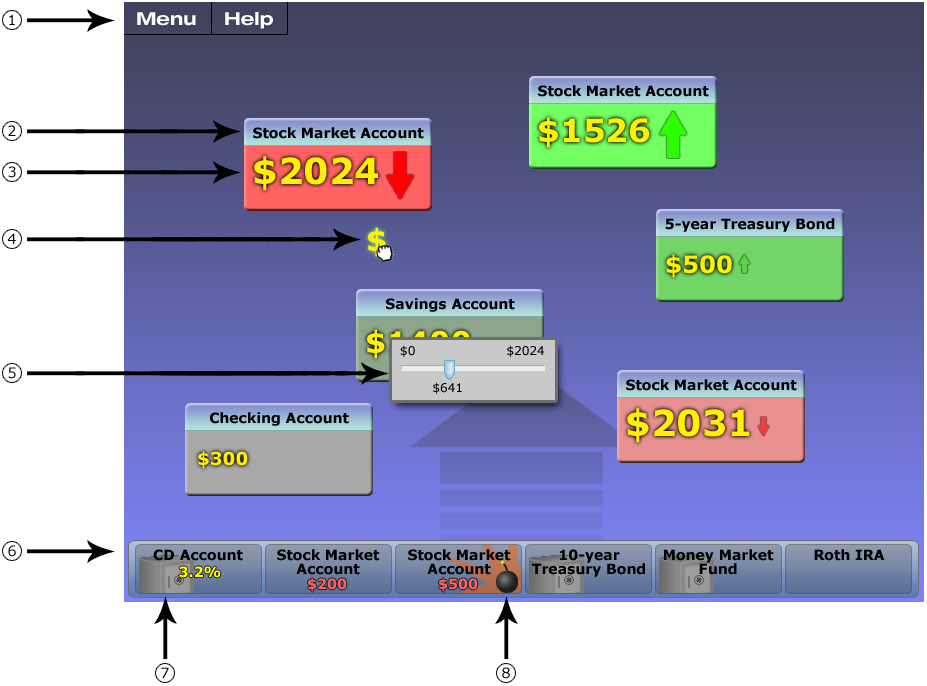

This is the only in-game screen. Here, the player can purchase new investment accounts from the horizontal purchase-bar at the bottom of the screen, transfer money across the purchased investment accounts (denoted by the floating windows), and re-arrange the position of the accounts on the screen.

- The player can click on the "Menu" button to return to the main menu screen, which was described above. The "Help" button sends the player to the tutorial video, which is also available from the main menu screen and by pressing F1 (which is a standard keyboard shortcut for help). Lastly, the player can press F2 to restart the game (which is also another standard keyboard shortcut).

- This is the title bar for an investment account that the player has purchased, and it is designed to mimic a typical window on Mac OSX or Microsoft Windows.

- The player can drag the window around the screen similar to how a user drags a window in Mac OSX or Windows.

- Hovering the mouse over the title bar changes the mouse cursor into the standard "move" cursor.

- The investment account contains the following functionality:

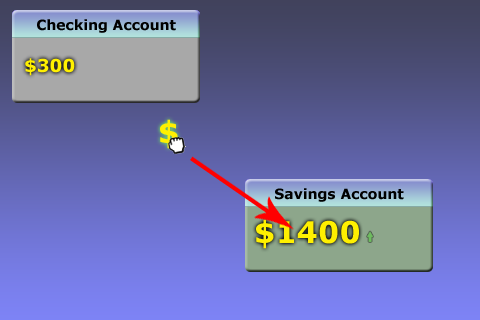

- Hovering the mouse over this portion of the window changes the mouse cursor into an open-hand, indicating that the player can drag-and-drop the money to another account. When the player engages the drag-and-drop operation, the mouse cursor changes into a closed-fist. This drag-and-drop operation was inspired by our observation of how users expect to move objects such as images in Microsoft Word or files in a graphical operating system.

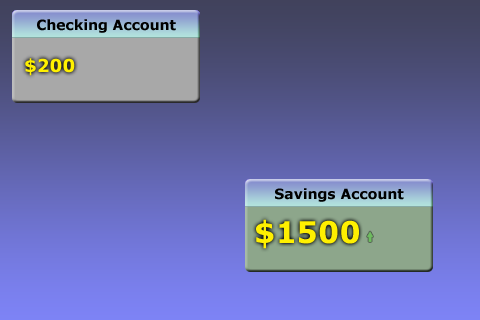

- The amount of money stored in the account is displayed in yellow font, and the font-size increases/decreases in response to the amount indicated. In a fast paced game, the font-size allows the user to quickly judge money amount.

- The shade of background-color indicates the overall historical growth of the money over a certain time period. Red shades indicate negative growth, green shades indicate positive growth, and gray indicates no change. These colors were inspired by our conversations during the interviews about indicators of risk.

- An arrow also accompanies the background-color in indicating money growth. Also, the arrow will increase/decrease in size to reflect the current rate of growth. And of course, the arrow can point up or down to indicate positive or negative growth.

- Certain accounts may have time constraints, which is indicated with a small clock in the corner showing the amount of time remaining.

- This is what the mouse cursor looks like when the player is drag-and-dropping money from one account to another.

- When a player drops money into an account, a dialog box appears with a slider indicating the amount of money to transfer. When this dialog is displayed, the mouse is immediately locked onto the slider bar. Horizontal motion of the mouse moves the slider bar left-and-right, and left-clicking the mouse will commit the money transfer. Limiting the controls during this portion of the task creates an affordance that cues the user about the current task. During this time, money in the source account is frozen so that it does not grow, simulating real-world money transfers. Emptying an account will effectively remove it from game play (with the exception of the player's checking account), also simulating real-world bank accounts.

- This is the purchase-bar, which displays 6 random investment accounts that the player can choose to purchase. This drag-and-drop operation was inspired by our observation of how users expect to move objects such as images in Microsoft Word or files in a graphical operating system.

- The accounts change every few seconds to create an element of suspense and uncertainty that makes the game more exciting.

- We chose to limit the number of available accounts to create unpredictability and to avoid overwhelming the user with too many options.

- Hovering the mouse over an account will change the mouse cursor into an open-hand, indicating drag-and-drop functionality.

- To purchase the account, the player drag-and-drops the desired account onto the game area.

- Certain accounts have a purchase price, such as stocks, and a similar dialog box will appear after the drag-and-drop operation as described above for transferring money. When money is required for the initial purchase, it is drawn from the player's checking account.

- If an account is risk-free, it will contain a "safe" icon in the background.

- If an account is highly volatile, it will contain a "bomb" icon in the background. This was inspired by our conversations with one interviewee who often used graphical indicators such as the skull-and-cross to indicate danger.

Three (3) scenarios of example tasks with sketches

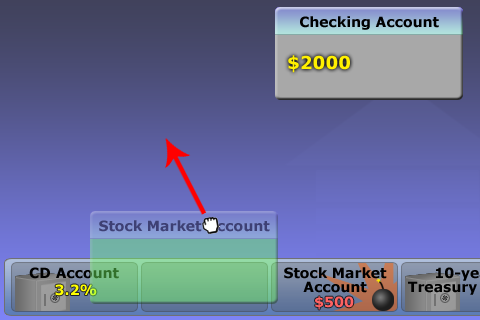

Creating an account

Let's say the player wants to purchase a new stock market account.

The player first notices that he has enough money in his checking account to match the share-price of $200. An available drag-and-drop operation is denoted by an open-hand mouse cursor when hovering over the item.

The player then drag-and-drops the account onto the game area.

Upon releasing the mouse button over the game area, a dialog window appears with a slider to purchase a number of shares up to the maximum amount allowed by his checking account. During this step, the mouse is locked onto the slider bar, and horizontal motion moves the slider left-and-right. Limiting the control in this manner eliminates the opportunity for accidentally clicking in the wrong area.

The player then left-clicks his mouse to commit the transaction for $400 worth of shares. If the player had selected $0 on the slider bar, the transaction would've been canceled with no effect taking place. Notice that the $400 was withdrawn from the player's checking account. The empty spot in the purchase-bar will then be replenished after a certain amount of time has elapsed.

Re-arranging the position of accounts on the screen

Due to the fast-paced nature of this game, part of the strategy is to position the accounts near certain other accounts so that money transfers can be performed quickly. So let's say the player wants to move his account to the lower-right-hand corner of the screen.

When the player hovers his mouse over the title bar, the mouse cursor changes into a standard "move" cursor indicating an available drag-and-drop operation.

The player then drags the account towards the desired location. This function is equivalent to the operation that we observed when our interviewees moved windows in Microsoft Windows around the screen.

The account is now located where the player wants it.

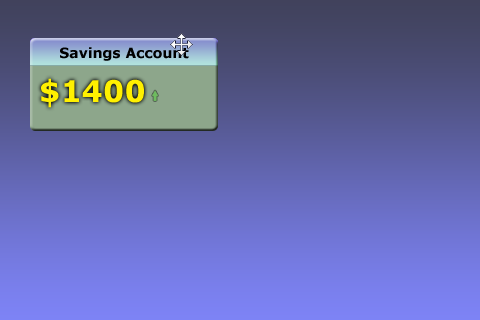

Moving money from one account to another

A core aspect of the game involves transferring money from one account to another. This allows the player to experiment with different account types. If the account works well, the player can transfer more money into the account. If the account is too volatile and suddenly losing lots of money, the player will want to transfer money away. Here's how a player would transfer money from the checking account into the savings account.

When the player hovers his mouse over the gray area of the window, the mouse cursor changes into an open-hand to indicate an available drag-and-drop operation.

The player then engages the drag-and-drop operation, changing the mouse cursor into a closed-fist with a dollar sign underneath it to indicate that money can be dropped into another account.

Once the player drops the dollar sign onto the savings account, a dialog window appears with a slider bar indicating the amount of money to transfer. Money in the source account is now frozen so that the values displayed on the slider bar do not fluctuate. During this step, the mouse is locked onto the slider bar, and horizontal motion of the mouse will move the slider left-and-right. Limiting the control in this manner eliminates the opportunity for accidentally clicking in the wrong area.

The player then left-clicks to commit the money transfer for $100. If the player had selected $0 on the slider bar, the transaction would've been canceled with no effect taking place. Notice that the $100 was withdrawn from the player's checking account and placed into the savings account.

Analysis of Approach (5 pts)

Pros: Our game is able to convey a significant amount of information in a very short period of time. In most cases, this type of approach would result in a failure, but in our case, since the game has very high replay value, the constant reinforcement of the information allows for the user to effectively digest and understand. Our game uses concepts that are prevalent in most of the successful flash games; it requires a combination of speed and concentration to be successful at playing it. By focusing on these skills, the game is able to have a very low learning curve. Since the user will have to be constantly processing information, they won't be thinking about actively learning, and so we can hurdle the problem of repetitive educational information quickly becoming boring. Even without teaching too much detail involving investment accounts, we are able to effectively and efficiently raise awareness, which should prompt the user to look into these accounts in more detail elsewhere.

Cons: The downside of our approach is that there is definitely a limit of how much educational information we can package in the game. Since the gameplay itself is fairly simple and the amount of time the user gets to play one round is limited, it would not be possible or prudent to try to teach too much. In that sense, we can only teach some of the basics of investment accounts; the user would have to look towards other sources afterward. In that sense, however, we have succeeded, as our objective is to teach them by making them more aware of investment accounts; awareness is the first step towards understanding and becoming knowledgeable about something.

Some non-game potential solutions are as follows:

- Research online

- Pros: Much more information, much more detailed, descriptive, up-to-date, and accurate.

- Cons: Hard to pick out the proper information needed, wealth of information can be intimidating, might be hard to find for people who are unaccustomed at looking things up online

- Read finance periodicals

- Pros: More information, fairly up-to-date, accurate

- Cons: Not everything is relative, may be somewhat biased, requires a small investment (not free)

- Ask friends or family member

- Pros: Easy, quick to access, availability is good

- Cons: Not always accurate, fairly biased, quality of information is dependent upon the other person's knowledge.

- Ask an investment banker

- Pros: Professional, accurate, answers can be tailored to the person asking

- Cons: Hard to find, availability is very limited

- Take a class

- Pros: Your will be taught by people who really know their stuff.

- Cons: It will be very theoretical. Possibly not too much hands-on experience. Some people also cannot sit through a class